Rifiniti is now part of Workplace Analytics by FM:Systems

FM:Systems Gains Advanced Workspace Analytics Through Rifiniti Acquisition

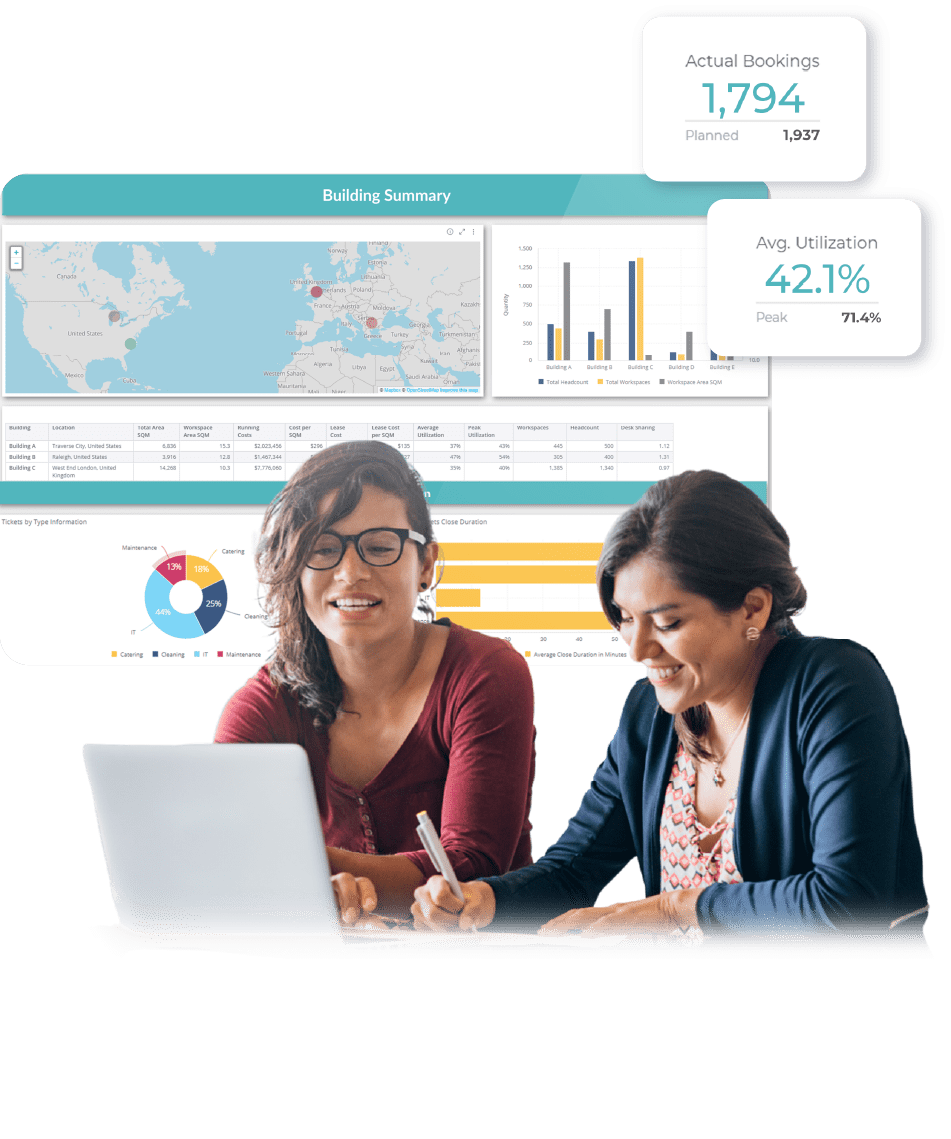

Workplace Analytics

Our facilities and real-estate analytics solutions enable your organization to unlock opportunities across your portfolio through sophisticated data science and machine-learning algorithms.

Build an ever-ready strategy

Find out why our 1,200+ customers around the globe can enjoy the strength of a single best-in-class solution – or unlock the power of our fully-integrated platform – to address their most pressing challenges today, tomorrow and 100 years from now.